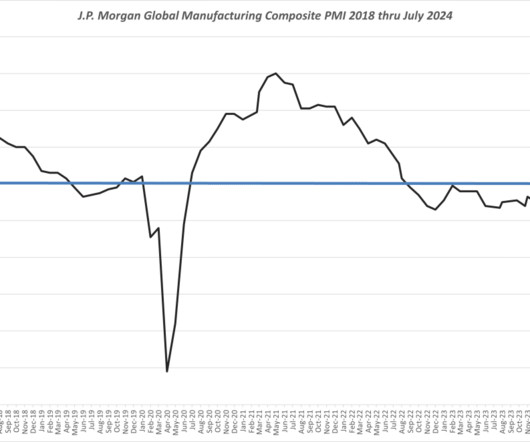

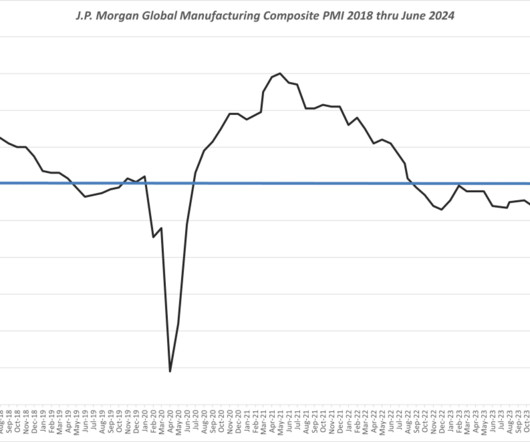

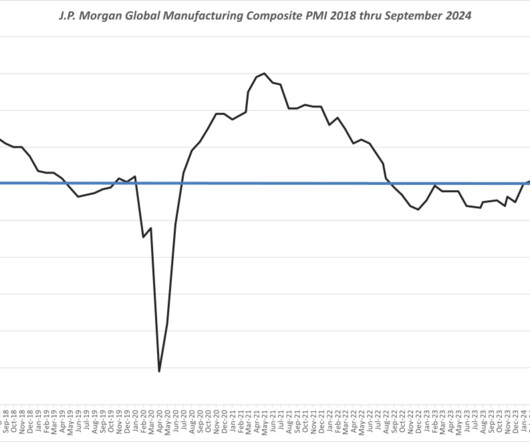

July 2022 Global Manufacturing Indices Indicating Declining Momentum

Supply Chain Matters

AUGUST 3, 2022

Also highlighted was that purchasing activity, stocks of purchases and finished goods inventories collectively rose in July. The bottom three were listed as Poland , Taiwan and Myanmar. . The top three regions exhibiting PMI growth were that of India, Australia and the Netherlands. Select Regional Highlights. United States.

Let's personalize your content