Aligning Supply Chain Metrics to Improve Value

Supply Chain Shaman

MAY 21, 2024

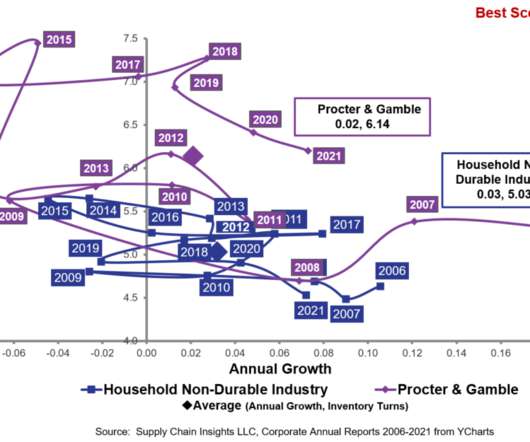

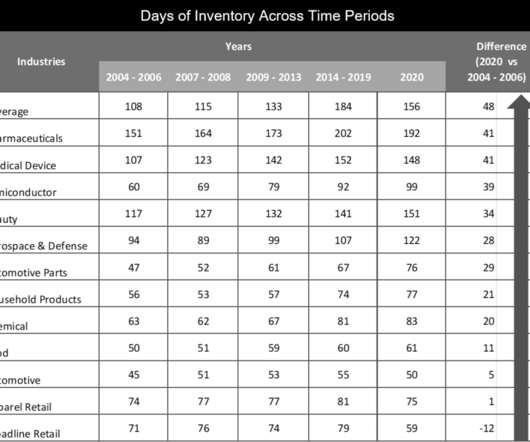

In 2016, we finished a study on continuous improvement. In the study, when we asked for the top elements of business pain to drive continuous improvement for companies greater than 5B$ in annual revenue, as shown in Figure 1, we found the largest issues with cross-functional alignment and availability of talent. What Drives Value?

Let's personalize your content